Most probably just a. CARA ISI E FILING 2022.

Such employee must serve under the same employer for a period of 12 months in a calendar year ie.

. Do Your Investments Align with Your Goals. Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan 2. Lembaga Hasil Dalam Negeri Malaysia LHDNM telah memaklumkan kepada semua pembayar cukai Tahunan Taksiran 2021 boleh mula mengisi E Filing.

Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Accountant when come to Borang B Borang BE submission a common question may ask from your customers. Setiap pengguna mestilah mengaktifkan NoPIN dahulu pada Login Kali Pertama bagi memperoleh sijil digital terlebih dahulu.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

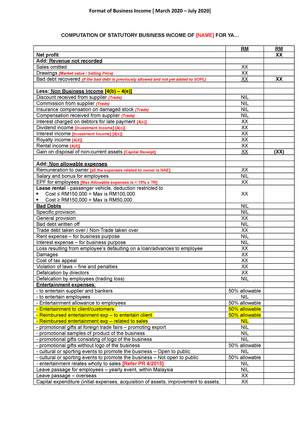

SUB-TOTAL BUSINESS INCOME after deducting capital allowances Less. Can I declare my business income if I receive a Form BE. Jan 1 to Dec 31.

Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Income other than business. Such employee must receive their employment income prescribed under Section 13 of the Income Tax Act 1967.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Brought forward losses from previous year TOTAL NET BUSINESS INCOME a add item 2 and deduct item 3 EMPLOYMENT Attach statement of salary from employer form CP 8A 8C 004 005 006 007010 009 008. Ensure all your individual details are correct.

In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other gains and. First at the top of the page to ensure that you have not already not registered previously. 30042022 15052022 for e-filing 5.

Once youve filled in all the necessary details double-check the information and click HantarSubmit. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Income tax return for partnership.

B dapatkan Borang BE sekiranya TIDAK menjalankan perniagaan. Find a Dedicated Financial Advisor Now. If approved you are required to complete the Share Transfer Form Form 32A this will need be witnessed by a.

Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan Senarai e-Borang. Enter the full name of the employee as per his or her identity cardpassport. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah 3. C isi semua ruangan yang berkaitan dengan HURUF BESAR dan gunakan pen mata bulat berdakwat hitam. Ad Free tax filing for simple and complex returns.

Form B is submitted by individuals with business income other than employment income for example sole proprietorship or partnership. Key in the employees income tax number in this item. PANDUAN LENGKAP CLAIM INCOME TAX BORANG BE.

Headquarters of Inland Revenue Board Of Malaysia. Business income should be declared in the Form B. Klik pada pautan e-Borang di bawah menu e-Filing.

A rujuk Nota Penerangan sebelum mengisi borang ini. Cara Isi Borang e-Filing Online 1. Pembayar Cukai Taksiran Tahunan 2021 boleh mula mengisi E Filing LHDN bermula pada akan dikemaskini 2022.

Guaranteed maximum tax refund. Income tax return for individual with business income income other than employment income Deadline. Not sure whether this is just a guidance or actually in the Income Tax Act 1967.

02 April 2020 Khamis hingga 03 April 2020 Jumaat. Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. Borang B Employment income and business income.

Quickly Prepare and File Your 2021 Tax Return. Go to e-BE Choose your corresponding income tax form ie. MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994.

Income tax return for individual who only received employment income. Berikut dikongsikan panduan cara langkah-langkah dalam mengisi borang cukai pendapatan secara online melalui ezHASiL. Jan 27 2017 1249 PM updated 4y ago.

首 RM 20000 税金 次 RM 3900 3 税率 RM 150 RM 117 RM 267 收入低于 RM35000 的报税人可得 RM 400 回扣 Rebat Cukai 因此小敏不需缴纳任何的税金 还没报税的朋友或许会觉得报税很复杂不过笔者相信只要报过一次税那么根本就不是什么问题了 报税前首先要有公司发出的薪金总表 EA表格然后就是找出可减免和扣税项目的收据. From Simple to Advanced Income Taxes. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak.

Langkah 1 Log Masuk Fungsi ini digunapakai oleh pengguna samada individu atau organisasi. But before that click on the link that says Please Check Your Income Tax No. 5 CARA PEMBAYARAN a.

E-BE if you dont have business income and choose the assessment year tahun taksiran 2015. I just want tax payable RM. Identification Passport No.

100s of Top Rated Local Professionals Waiting to Help You Today. Malaysia Personal Tax Relief Income Tax Calculate this personal tax planner can calculate personal income tax in Malaysia key in the tax relief the tax amount tax bracket tax rate calculate automatic. Meanwhile if you did not register your business then use the usual BE form for those with non-business income to file your tax as a freelancer instead.

Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

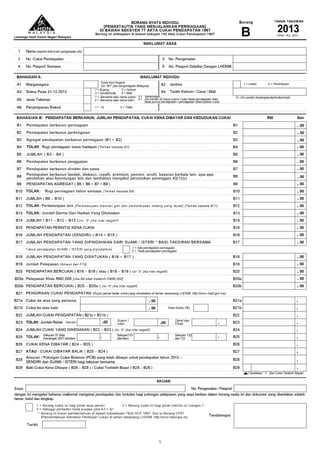

BORANG B 2020 INDIVIDU PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN 2020 TAHUNBorang TAKSIRAN B LEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG NYATA INDIVIDU PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN DI BAWAH SEKSYEN 77 AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI. The statute of limitations in Malaysia is 6 years but specifically for tax LHDN says you need to keep records for 7 years.

700 malam hingga 700 pagi. 上网登记账号 Register Income Tax 第一次报税的朋友我们需要先登陆 httpedaftarhasilgovmy 点击 Borang Pendaftaran Online 填写个人资料登记账号 填写完毕后点击呈交 系统就会显示我们的基本资料包括我们个人的所得税参考号码 No Rujukan Cukai SGXXXXXXX 这辈子就只有唯一这个 有了 No Rujukan Cukai 我们还要申请 No Pin 才. 30062022 15072022 for e-filing 6.

1 Joint in the name of husband 2 Joint in the name of wife 3 Separate 4 Self whose spouse has no income no source of income or has tax exempt income 5 Self Single divorcee widow widower deceased.

Personal Income Statement Template Check More At Https Nationalgriefawarenessday Com 28061 Personal Income Statement Template

Borang Agen 18 Images Khasiat Daun Minyak Kayu Putih Wedang Angkringan Jogja Angkringan Jogja Borang Agen Direct Borang D Perniagaan Borang G Terengganu Pembiayaan Peribadi I Kuwait Finance House Contoh Pengisian Borang

Business Income Format Of Business Income March 2020 July 2020 Computation Of Statutory Studocu

Income Tax Form 12 Download 12 12 Pdf Seven Things You Should Know About Income Tax Form 12 Tax Forms Income Tax Personal Financial Statement

Penerimaan Sagu Hati In English Wallpaper

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

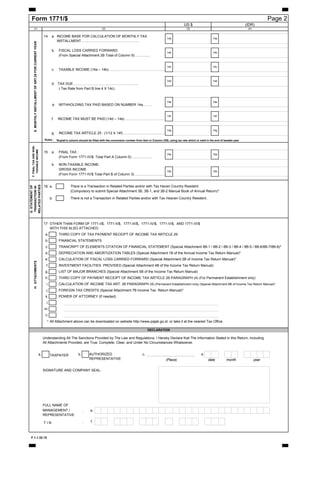

General Instructions For The Completion Pdf Form 1771

The Complete Income Tax Guide 2022

General Instructions For The Completion Pdf Form 1771

Guide To Using Lhdn E Filing To File Your Income Tax

General Instructions For The Completion Pdf Form 1771

General Instructions For The Completion Pdf Form 1771

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Thread By Nizamiks Panduan Isi Tax Income E Filing 2019 Pada Tahun 2020 Deadline 30 April 2020 Ini Adalah E Filing 2019 Yang Terbaru Jadi Ada Beberapa Perbe

General Instructions For The Completion Pdf Form 1771

Siape Lagi Blom Hantar Borang Income Tax Korang Dah Hantar Ke Blom Borang Income Tax Utk 2017 Semua Da Nak Naik Bulan Mei Ni Tar Movies Movie Posters Smart

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022